FOR QUERIES, FEEDBACK OR ASSISTANCE

Best of support with us

4Achievers Corporate Training in UK Accounting Training in Gurgaon Training Institute is a Known name and has gained the attention of many students due to its best Corporate Training in UK Accounting Training in Gurgaon training institute. The institute offers various courses according to their requirements and provides job opportunities too. MOC Interview of the Classroom student from 4Achievers Corporate Training in UK Accounting Training in Gurgaon Training Institute will provide you with an idea about the work culture present there.

If you have been wanting to be a part of Technology, but are not sure of where to start, then 4Achievers is the right place for you! With our state-of-the-art training facilities and immersive classroom programs, we will prepare you for tomorrow's digital world. We offer a comprehensive curriculum that covers every aspect of technology, from programming languages to software development tools. We also provide on-site coaching sessions that will help bridge the gap between theory and practical applications. And what makes us stand apart from other institutes is our commitment to quality education. All our faculty members are industry experts who have years of experience in their respective fields. From top MNCs like Netflix and Microsoft, to startup companies like Udemy and Wootric, they have vast expertise that can be applied in real life scenarios.

Joining 4Achievers Corporate Training in UK Accounting Training in Gurgaon ? We are a technology-based training institute that offers best-in-class courses on various technologies. Our trainers teach students how to use the latest tools and applications so they can be productive and make the most of their skills.

In addition to offering classes, we have many recruitment opportunities available for candidates that are seeking jobs in fields such as software development, e-commerce, and more.

Corporate Training in UK Accounting Training in Gurgaon has changed the world, and it's time you change with it. Today, at 4Achievers Corporate Training in UK Accounting Training in Gurgaon , you'll find classes that will prepare you for tomorrow's jobs.

We offer state-of-the-art equipment and software so you can learn in a comfortable environment. And 4Achievers Corporate Training in UK Accounting Training in Gurgaon Course trainers are experts who can help you master new skills quickly.

If you're looking for a career that will give you endless possibilities, then enroll today! So don't wait any longer!

4Achievers is a dedicated course training- company that helps individuals achieve their goals. We have a team of experienced and qualified trainers who are passionate about helping people achieve their dreams and aspirations.

4Achievers courses are designed to help you learn new skills, access new opportunities, and develop new career paths. We offer a wide range of courses, all of which are designed to help you reach your goals. So, if you're looking to learn new things, or take your current skills to the next level, look no further than 4Achievers.

We think that knowledge is power, and we want to give you the tools you need to achieve your goals. So be sure to check out our website frequently for the latest Course Program and Syllabus!

4Achievers Placement Assistance is the perfect solution for students who have failed in securing a job after graduation. 4Achievers provide them with the necessary resources and guidance to help them find the best job possible.

4Achievers team of professionals has extensive experience in the completing course, placement field, and we are always on standby to help our students. Contact us today to learn more about our program!

4Achievers is a globally recognized training institute that teaches Corporate Training in UK Accounting Training in Gurgaon to budding professionals. With their state-of-the-art classroom, the course is engaging and practical at the same time. We guarantee that you'll leave class feeling more confident and ready to take on Corporate Training in UK Accounting Training in Gurgaon projects!

If you're looking to upskill your team in the latest technology, you need the right classroom infrastructure. At Corporate Training in UK Accounting Training in Gurgaon Training Institute, we offer courses that cater to various industries and businesses. Our classrooms are equipped with all the latest gadgets and software, so your employees can learn at their own pace.

4Achievers is here to teach you about the latest technologies and online tools that can help enhance your skills. With 4Achievers online Corporate Training in UK Accounting Training in Gurgaon Course , you can learn any topic from a beginner level all the way up to an advanced one. All of our classes are designed for beginner-level users so that you'll be comfortable with whatever information we share with you.

4Achievers also provide training material so that students get the best of both worlds - hands-on experience with latest tools and techniques along with theoretical knowledge too! Not only will your learning curve be steeped in technological advancements, but you'll also be getting relevant skills that will definitely help you in future career choices.

Are you looking for an institute that offers high-quality Corporate Training in UK Accounting Training in Gurgaon training? Look no further than 4Achievers Corporate Training in UK Accounting Training in Gurgaon Training Institute . We provide affordable and quality Corporate Training in UK Accounting Training in Gurgaon courses that will help you get ahead in the competitive job market. Corporate Training in UK Accounting Training in Gurgaon affordable and quality Course is designed to help people get their foot in the door with a Corporate Training in UK Accounting Training in Gurgaon job. 3 Month to 6 Month Corporate Training in UK Accounting Training in Gurgaon Training Program

Looking for a Corporate Training in UK Accounting Training in Gurgaon training institute that offers comprehensive courses on various technologies? Look no further than 4Achievers Technology. We offer courses that are suitable for both beginner and experienced users. Our courses are Duration-Long, and are guaranteed to give you the skills and knowledge you need to succeed in your chosen field.Quality class provides students with the skills they need to land a Corporate Training in UK Accounting Training in Gurgaon job.

If you're looking for an all-inclusive Corporate Training in UK Accounting Training in Gurgaon training institute , then 4Achievers is the perfect place for you. 4Achievers institute offers best-in-class Corporate Training in UK Accounting Training in Gurgaon training courses that will equip you with the skills and knowledge you need to succeed in the Corporate Training in UK Accounting Training in Gurgaon industry.Corporate Training in UK Accounting Training in Gurgaon course Test Series Classed provides students with the necessary resources to pass their Corporate Training in UK Accounting Training in Gurgaon research tests.

Are you looking for a top-notch Corporate Training in UK Accounting Training in Gurgaon training institute ? Look no further, 4Achievers Corporate Training in UK Accounting Training in Gurgaon is the right choice for you! Our institute offers state-of-the-art Corporate Training in UK Accounting Training in Gurgaon courses that will help you gain the skills and knowledge you need to stand out in the job market.If you are looking to improve your Corporate Training in UK Accounting Training in Gurgaon skills, I would recommend enrolling in a live project working, test series classed class.

Want to make a career change? Do you want to learn new technologies in a hands-on environment? Then check out our Corporate Training in UK Accounting Training in Gurgaon Training Institute ! We offer various Corporate Training in UK Accounting Training in Gurgaon courses that will help you get ahead in your Career.Corporate Training in UK Accounting Training in Gurgaon Corporate Training in UK Accounting Training in Gurgaon Course MOC Interview Preparation Classed can help you get a job.If you're looking to improve your Corporate Training in UK Accounting Training in Gurgaon skills, this is the course for you!

4Achievers offers Corporate Training in UK Accounting Training in Gurgaon training courses that are job assistance, then 4Achievers Corporate Training in UK Accounting Training in Gurgaon Institute is the right place for you. 4Achievers courses are designed to help you get a foothold in the tech industry and get started on your career ladder. 4Achievers cover different technologies, and 4Achievers institutes offer hands-on training so that you can learn how to use these technologies in the real world.

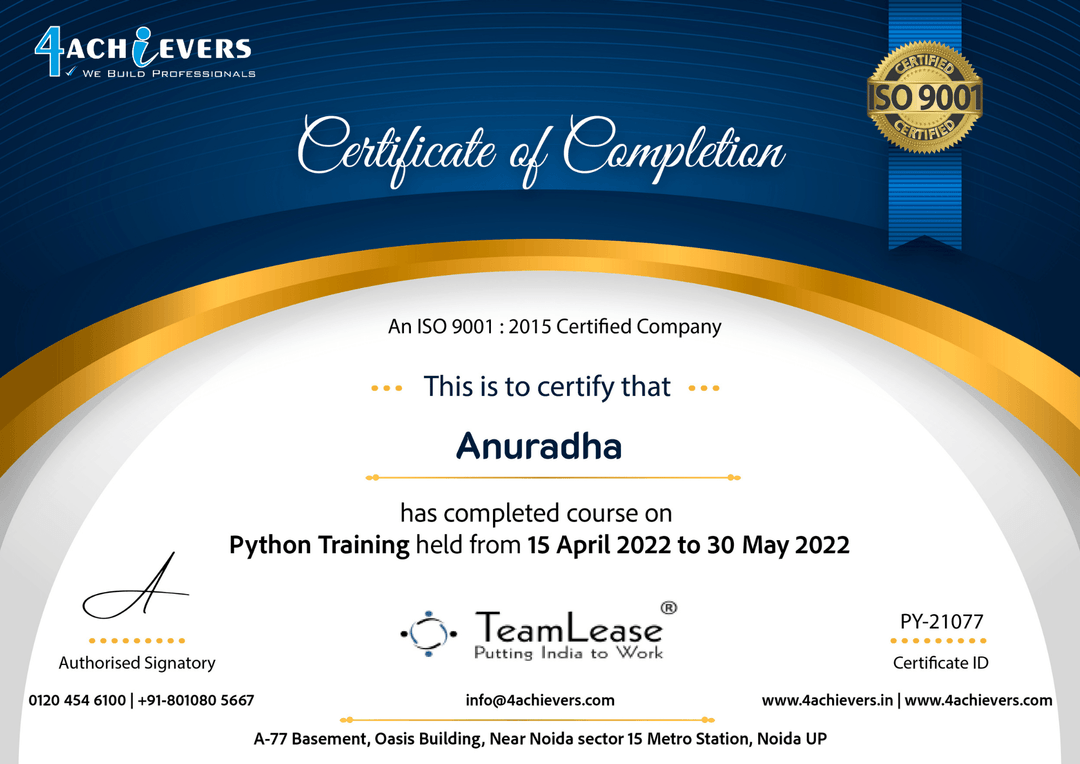

Are you looking to take your accounting skills to the next level? 4Achieversn 4achievers' Corporate Training in UK Accounting course in Gurgaon is the perfect choice for you. This course is designed to provide you with the knowledge and skills you need to become an expert in UK accounting.

4Achievers course is divided into two parts, the first part is a comprehensive overview of the UK accounting system and the second part is a practical application of the concepts. In the first part, you will learn about the principles of UK accounting, the different types of accounts, the different types of transactions, and the different types of reports. You will also learn about the different types of financial statements and the different types of taxes.

In the UK, corporate entities must meet certain requirements to be able to recognise obligations under finance leases. These requirements are outlined in the Financial Reporting Standard (FRS) 102. 4Achievers first requirement is that the asset being leased must be identified and its fair value must be determined, either through a market valuation or an estimate of the expected future cash flows associated with the asset. 4Achievers lessor must then determine the present value of the minimum lease payments. This is the amount of the lease payments, which must be paid in order to obtain the asset.

4Achievers second requirement is that the asset must be recognised as an asset of the lessee in the company’s balance sheet. This means that the asset must be recorded as part of the company’s assets and liabilities, with any associated costs being included in the financial statements. 4Achievers lease payments must also be recognised as a liability in the balance sheet.

4Achievers third requirement is that the lease payments must be classified as either an operating or a finance lease. An operating lease is one where the lessee pays for the use of the asset, rather than for the asset itself. A finance lease is one where the lessee pays for both the asset and the use of the asset. 4Achievers lessee must also recognise any costs associated with the lease as an expense in the income statement.

4Achievers fourth requirement is that the lessee must also recognise any gain or loss on the lease in the income statement. This is determined by the difference between the asset’s fair value and the present value of the minimum lease payments. If the asset’s fair value is greater than the present value of the minimum lease payments, then the lessee must recognise a gain on the lease. Conversely, if the asset’s fair value is less than the present value of the minimum lease payments, then the lessee must recognise a loss on the lease.

Finally, the lessee must also recognise any costs associated with the disposal of the asset. This is determined by the difference between the proceeds from the disposal of the asset and the carrying amount of the asset on the balance sheet. Any gain or loss on the disposal of the asset must also be recognised in the income statement.

In the United Kingdom, in order for a corporate entity to be eligible to recognize a provision for deferred tax assets, the company must meet several conditions.

First, the company must demonstrate the existence of a current tax liability or a taxable transaction that is scheduled to occur in the future. This tax liability or transaction must be expected to generate taxable income in order to be eligible for the deferred tax asset recognition.

Second, the company must demonstrate that it is reasonably certain that the tax assets resulting from the tax liability or taxable transaction will be realized in the future. In other words, the company must be able to demonstrate that the tax assets will be realized in the future and not become worthless due to unforeseeable events.

Third, the company must demonstrate the ability to utilize the deferred tax assets in the future. This ability may be demonstrated by the company having sufficient taxable income in the future to offset the deferred tax assets.

Fourth, the company must demonstrate that the deferred tax assets are realizable within the foreseeable future. This means that the deferred tax assets must be realized within the period specified by the applicable tax laws.

Finally, the company must document its provision for deferred tax assets in accordance with the applicable tax laws and regulations. 4Achievers company must also provide adequate evidence to support the deferred tax asset recognition.

In conclusion, in order for a corporate entity to be eligible to recognize a provision for deferred tax assets in the United Kingdom, the company must meet several conditions including demonstrating the existence of a current tax liability or a taxable transaction, demonstrating that the tax assets will be realized in the future, demonstrating the ability to utilize the deferred tax assets in the future, demonstrating that the deferred tax assets are realizable within the foreseeable future, and documenting its provision for deferred tax assets in accordance with the applicable tax laws and regulations.

In the United Kingdom, corporate entities must meet certain requirements for the recognition of provisions for future income tax. Firstly, the provision must be related to a current taxation liability, or a liability that is expected to arise in the future from an existing transaction or event. Provision for future income tax should be recognised when the amount of the liability can be measured reliably.

4Achievers amount of the provision should be based on the tax payable for the current or most recent period for which the amount of tax can be estimated, as well as a reasonable estimate of any adjustments that may arise from the final determination of the tax liability. If a company is able to forecast the amount of taxes payable in the future, they should use this amount when determining their provision for future income tax.

In addition to the measurement, the provision should also be reviewed for any changes that may occur in the estimated future tax liabilities, such as changes to tax rates or changes to the amount of income subject to taxation. Any changes to the estimated tax liability should be taken into account when calculating the provision for future income tax.

Finally, the company should ensure that they have sufficient resources to meet the estimated future tax liabilities. Companies should ensure that they have sufficient cash or liquid assets available to cover the estimated future taxes. If a company does not have sufficient resources, they should make arrangements to obtain the necessary funds to cover the estimated future taxes.

In the UK, corporate entities must meet certain requirements when recognizing provisions for foreign exchange gains and losses. 4Achievers accounting standards require companies to calculate foreign exchange gains and losses in accordance with their functional currency. 4Achievers functional currency is the currency of the primary economic environment in which the entity operates and generates its income.

Companies must assess the exchange rate at the reporting date and compare it with the rate at the date of acquisition or recognition of the asset or liability. Companies must also consider the underlying transaction and its impact on the exchange rate. If a transaction takes place in a different currency, companies must calculate the gain or loss on exchange.

In addition, companies must also consider any forward contracts, options, or other hedging instruments related to the foreign currency transaction. For example, a company that has entered into a forward contract to purchase foreign currency must account for the gains or losses resulting from the contract.

Companies must also disclose any foreign exchange gains and losses in their financial statements. This includes any related hedging activities and any amounts that have been deferred or hedged in the past.

In conclusion, companies in the UK must consider the functional currency, the exchange rate at the reporting date, the underlying transaction, and any related hedging activities when recognizing provisions for foreign exchange gains and losses. Companies must also disclose any related foreign exchange gains and losses in their financial statements.

In the UK, corporate entities must comply with accounting standards when it comes to provision for income taxes. Generally Accepted Accounting Principles (GAAP) require corporations to recognize a provision for income taxes when it is certain that an income tax liability has been incurred and can be measured reliably.

4Achievers provision for income taxes must include taxes currently due and payable, as well as deferred taxes that relate to temporary differences between the carrying amount of an asset or liability and its tax base. For example, if a company has an asset that is recorded on its balance sheet at a higher amount than its tax base, then the company must recognize a provision for income taxes.

4Achievers provision for income taxes must also include the current year's income tax liability, as well as any taxes expected to be paid in future years. 4Achievers amount of the provision for income taxes must be based on the estimated rate of taxation for the current year, as well as any changes in the rate of taxation that may occur in future years.

4Achievers corporation must also consider any tax credits or incentives that may be available. Any applicable credits or incentives must be taken into account when calculating the provision for income taxes.

Finally, the provision for income taxes must be included in the company's financial statement. 4Achievers provision for income taxes should be reported separately from other income taxes and should be stated net of any related deferred tax assets or liabilities.

In summary, in order to recognize a provision for income taxes, corporate entities in the UK must comply with GAAP, consider current and future taxes, take into account any applicable credits or incentives, and report the provision separately in their financial statements.

For corporate entities in the UK, the recognition of provision for capital gains taxes requires that the amount of the tax liability must be reliably estimated and the company must have an existing liability to pay the tax. 4Achievers company must also have an existing asset that can be sold to generate a capital gain or an existing liability that can generate a capital loss.

In order to be recognised, the company must have a reasonable expectation of having to pay the capital gains tax. 4Achievers company must also have a reasonable expectation that the asset can be sold for a gain or that the liability can be settled for a loss.

4Achievers amount of the provision should also be based on reliable and up-to-date information. 4Achievers company must have sufficient information available to them to estimate the amount of tax that would be due on the gain or loss.

When estimating the amount of the provision, the company must take into account any applicable exemptions or deductions, such as the annual exemption, or the entrepreneurs' relief.

4Achievers company must also consider any changes in taxation rates that may affect the amount of the provision. For example, if the standard rate of capital gains tax has changed, the amount of the provision must be adjusted accordingly.

Finally, the company must ensure that the provision is properly accounted for in their accounts. This includes ensuring that any charges or credits relating to the provision are properly reflected in the accounts.

In the UK, companies are required to recognise losses on investments under the Companies Act 2006. 4Achievers act states that companies must make provisions for potential losses on investments when there is evidence of an impairment of the investment’s value.

In order to recognise a provision for a loss, the company must have reliable evidence of the impairment and be able to measure the amount of the impairment loss. 4Achievers company must also be able to demonstrate that it is probable that the loss will be incurred at some point in the future.

4Achievers Companies Act 2006 also states that companies should use a consistent approach when recognising provisions for potential losses on investments. This means that companies should use the same criteria for making provisions for all investments.

Companies must also consider the effect of any impairment losses on their financial statements. This includes considering the impact of any impairments on the company’s income statement, balance sheet, and cash flow statement.

Finally, companies should make sure that provisions for losses on investments are adequately disclosed in their financial statements. This includes providing details about the investments, the impairment losses, and the amount of the provision. Companies should also explain how the impairments were estimated and the reasons for taking the provision.

In the UK, corporate entities must comply with the Financial Reporting Standard 102 (FRS 102) in order to recognize provisions for share-based payments. Specifically, FRS 102 requires that a provision be recognised for share-based payments when the agreement gives the employee the right to receive cash or other assets from the employer, or when the employer incurs a present obligation for them to settle the obligation on a future date.

In order for the provision to be recognised, the entity must have a reasonable estimate of the number of equity instruments that will vest. 4Achievers fair value of the equity instruments granted should be calculated based on the market value at the date of the grant, taking into account the terms and conditions of the agreement. 4Achievers costs associated with the provision must be recognised on a systematic basis over the vesting period of the agreement.

4Achievers entity must also disclose the following information in its financial statements: the total amount of share-based payments; the total amount of share-based payment expense recognised; the total amount of share-based payment expense recognised in the period; and the total number of equity instruments granted to employees during the period.

In addition, the entity must also provide information on the expected cash flow from the share-based payment provision, the expected vesting period, and the expected exercise price of the equity instruments. 4Achievers entity must also disclose the method used to calculate the fair value of the equity instruments granted.

Finally, the entity must review its share-based payment provisions at each reporting date and make any necessary adjustments to the financial statements.

4Achievers requirements for the recognition of provisions for employee benefits for corporate entities in the UK are determined by the Companies Act 2006. These provisions are based on the Financial Reporting Standard (FRS) 19, which provides guidance on how to account for employee benefits. 4Achievers key requirements of FRS 19 include:

1. An entity must disclose the amount of provisions made for employee benefits, including any actuarial gains and losses.

2. All provisions must be measured at their present value, taking into account expected future costs and any expected future benefits.

3. Provisions must be recognised when a legal or constructive obligation exists, and when it is probable that the associated outflow of economic resources will be required to settle the obligation.

4. Any changes in the present value of the provisions must be reported in the annual financial statements.

5. Actuarial gains and losses must be recognised in profit or loss for the period in which they occur.

6. Provisions should not be recognised for future salary or wage increases, or for any other future benefits arising from an increase in the number of employees.

7. A provision must be recognised for employee benefits that are expected to be settled after the end of the reporting period.

8. An entity must disclose the amounts of employee benefit expenses recognised in profit or loss for the period, and the related amount of actuarial gains and losses.

In the UK, the requirements for recognition of provisions for asset retirement obligations (ARO) by corporate entities are outlined in the Financial Reporting Standard 102 (FRS 102). This standard sets out the principles and requirements for accounting for and measuring AROs.

Under FRS 102, AROs must be recognised by an entity if it has a legal or constructive obligation to retire an asset and can reliably estimate the costs of retirement. A legal obligation arises from a court judgement, statute or contract, while a constructive obligation is an obligation that arises from the actions or behaviour of an entity.

To recognise an ARO, the entity must be able to estimate the future expenditures that will be required to settle the obligation and be able to reliably measure the present value of those expenditures. 4Achievers entity should also be able to estimate the cost of the related asset that will be retired, in order to calculate the net cost of the ARO.

Once recognised, AROs should be measured at fair value, which is defined as the present value of the estimated future expenditures. 4Achievers fair value should be reviewed at each reporting date and adjusted if necessary.

4Achievers entity should also recognise a liability in its financial statements for the ARO, along with a corresponding increase in the carrying amount of the related asset. This should be recognised as a charge in the profit or loss statement, as well as an increase in the asset retirement obligation liability.

Finally, the entity should also recognise a provision for the costs of the ARO, which should be measured at the same value as the liability. 4Achievers provision should be recognised as an expense in the profit or loss statement.

at 4Achievers

Very Satisfied

at

4Achievers Corporate Training in Machine Learning Training in Gurugram Course Covers: Introduction | Basic | Project Implementation | Testing | Architecture | Advance Learning | Interview Preparation | JOB Assistance.

4Achievers Corporate Training in Advance Excel with VBA Training in Gurugram Course Covers: Introduction | Basic | Project Implementation | Testing | Architecture | Advance Learning | Interview Preparation | JOB Assistance.

4Achievers Corporate Training in Business Analytics Training in Gurugram Course Covers: Introduction | Basic | Project Implementation | Testing | Architecture | Advance Learning | Interview Preparation | JOB Assistance.

4Achievers Corporate Training in Net Suites Training in Gurugram Course Covers: Introduction | Basic | Project Implementation | Testing | Architecture | Advance Learning | Interview Preparation | JOB Assistance.

4Achievers Corporate Training in Oracle Fusion Training in Gurugram Course Covers: Introduction | Basic | Project Implementation | Testing | Architecture | Advance Learning | Interview Preparation | JOB Assistance.

4Achievers Corporate Training in Java Programming Training in Gurugram Course Covers: Introduction | Basic | Project Implementation | Testing | Architecture | Advance Learning | Interview Preparation | JOB Assistance.

4Achievers Corporate Training in US IT Staffing Training in Gurugram Course Covers: Introduction | Basic | Project Implementation | Testing | Architecture | Advance Learning | Interview Preparation | JOB Assistance.

4Achievers Corporate Training in Tableau Training in Gurugram Course Covers: Introduction | Basic | Project Implementation | Testing | Architecture | Advance Learning | Interview Preparation | JOB Assistance.

Are you looking to find your next job in trending technology? 4Achievers has the perfect solution for you. 4Achievers software testing course will teach you everything you need to become a successful Expert. Not only that, but 4Achievers program is available online and offline class and can be completed in just a few weeks. so don't wait any longer and sign up today!

First touchpoint for customer Initial handling of all customer tickets Track to closure of customer tickets by assisting the responsible teams System software and AWS/Azure infrastructure L1/L2 support Newgen solution / application L1/L2 support Responsib

Experience: 0 to 4 years Qualification:B.SC, B.Tech/BE/MCA Skills in one or more of JavaScript,CSS, Web application framework viz. Sencha EXT JS, JQuery etc., Delphi,C,C++,or Java..net,testing Cloud Administrator-managing Windows based Servers

Developing and deploying new applications on the windows azure PAAS platform using C#, .net core . Participation in the creation and management of databases like SQL server and MySQL Understanding of data storage technology (RDBMS, NO SQL). Manage applica

Experience of Dev Ops technologies, architectures and processes for 3 yrs Cloud Infrastructures Solutions: AWS EC2 ECS, S3 Cloudfront, RDS, Spot Instances, VPC, IAM, Security Groups, ELB etc), GCP, CI/CD Jenkins Containerization: Docker, Kubernetes System

Must have good knowledge of Google Cloud (GCP), Good To Have- AWS and. Azure Cloud automation, with overall cloud computing experience. Good knowledge of Windows Server and IIS (Internet Information Services). Good knowledge of .NET applications (ASP.Net,

Good Knowledge in both Manual Testing and Automation Testing,Strong experience in writing test scenarios and test cases Strong knowledge on Selenium, Appium, Microsoft SQL and Jmeter Adept in functional testing and reporting defects

Design, execute and report software tests, Review business / software requirements and provide inputs. Prepare test cases, test scripts and test data., Execute tests (manual / automated). Report defects and assist in their understanding., Analyse test re

Good Knowledge in both Manual Testing and Automation Testing,Strong experience in writing test scenarios and test cases Strong knowledge on Selenium, Appium, Microsoft SQL and Jmeter Adept in functional testing and reporting defects

4Achievers offers the step-by-step guide to get your dream job after completing Course.