FOR QUERIES, FEEDBACK OR ASSISTANCE

Best of support with us

4Achievers Corporate Training in UK Accounting Training in Mohali Training Institute is a Known name and has gained the attention of many students due to its best Corporate Training in UK Accounting Training in Mohali training institute. The institute offers various courses according to their requirements and provides job opportunities too. MOC Interview of the Classroom student from 4Achievers Corporate Training in UK Accounting Training in Mohali Training Institute will provide you with an idea about the work culture present there.

If you have been wanting to be a part of Technology, but are not sure of where to start, then 4Achievers is the right place for you! With our state-of-the-art training facilities and immersive classroom programs, we will prepare you for tomorrow's digital world. We offer a comprehensive curriculum that covers every aspect of technology, from programming languages to software development tools. We also provide on-site coaching sessions that will help bridge the gap between theory and practical applications. And what makes us stand apart from other institutes is our commitment to quality education. All our faculty members are industry experts who have years of experience in their respective fields. From top MNCs like Netflix and Microsoft, to startup companies like Udemy and Wootric, they have vast expertise that can be applied in real life scenarios.

Joining 4Achievers Corporate Training in UK Accounting Training in Mohali ? We are a technology-based training institute that offers best-in-class courses on various technologies. Our trainers teach students how to use the latest tools and applications so they can be productive and make the most of their skills.

In addition to offering classes, we have many recruitment opportunities available for candidates that are seeking jobs in fields such as software development, e-commerce, and more.

Corporate Training in UK Accounting Training in Mohali has changed the world, and it's time you change with it. Today, at 4Achievers Corporate Training in UK Accounting Training in Mohali , you'll find classes that will prepare you for tomorrow's jobs.

We offer state-of-the-art equipment and software so you can learn in a comfortable environment. And 4Achievers Corporate Training in UK Accounting Training in Mohali Course trainers are experts who can help you master new skills quickly.

If you're looking for a career that will give you endless possibilities, then enroll today! So don't wait any longer!

4Achievers is a dedicated course training- company that helps individuals achieve their goals. We have a team of experienced and qualified trainers who are passionate about helping people achieve their dreams and aspirations.

4Achievers courses are designed to help you learn new skills, access new opportunities, and develop new career paths. We offer a wide range of courses, all of which are designed to help you reach your goals. So, if you're looking to learn new things, or take your current skills to the next level, look no further than 4Achievers.

We think that knowledge is power, and we want to give you the tools you need to achieve your goals. So be sure to check out our website frequently for the latest Course Program and Syllabus!

4Achievers Placement Assistance is the perfect solution for students who have failed in securing a job after graduation. 4Achievers provide them with the necessary resources and guidance to help them find the best job possible.

4Achievers team of professionals has extensive experience in the completing course, placement field, and we are always on standby to help our students. Contact us today to learn more about our program!

4Achievers is a globally recognized training institute that teaches Corporate Training in UK Accounting Training in Mohali to budding professionals. With their state-of-the-art classroom, the course is engaging and practical at the same time. We guarantee that you'll leave class feeling more confident and ready to take on Corporate Training in UK Accounting Training in Mohali projects!

If you're looking to upskill your team in the latest technology, you need the right classroom infrastructure. At Corporate Training in UK Accounting Training in Mohali Training Institute, we offer courses that cater to various industries and businesses. Our classrooms are equipped with all the latest gadgets and software, so your employees can learn at their own pace.

4Achievers is here to teach you about the latest technologies and online tools that can help enhance your skills. With 4Achievers online Corporate Training in UK Accounting Training in Mohali Course , you can learn any topic from a beginner level all the way up to an advanced one. All of our classes are designed for beginner-level users so that you'll be comfortable with whatever information we share with you.

4Achievers also provide training material so that students get the best of both worlds - hands-on experience with latest tools and techniques along with theoretical knowledge too! Not only will your learning curve be steeped in technological advancements, but you'll also be getting relevant skills that will definitely help you in future career choices.

Are you looking for an institute that offers high-quality Corporate Training in UK Accounting Training in Mohali training? Look no further than 4Achievers Corporate Training in UK Accounting Training in Mohali Training Institute . We provide affordable and quality Corporate Training in UK Accounting Training in Mohali courses that will help you get ahead in the competitive job market. Corporate Training in UK Accounting Training in Mohali affordable and quality Course is designed to help people get their foot in the door with a Corporate Training in UK Accounting Training in Mohali job. 3 Month to 6 Month Corporate Training in UK Accounting Training in Mohali Training Program

Looking for a Corporate Training in UK Accounting Training in Mohali training institute that offers comprehensive courses on various technologies? Look no further than 4Achievers Technology. We offer courses that are suitable for both beginner and experienced users. Our courses are Duration-Long, and are guaranteed to give you the skills and knowledge you need to succeed in your chosen field.Quality class provides students with the skills they need to land a Corporate Training in UK Accounting Training in Mohali job.

If you're looking for an all-inclusive Corporate Training in UK Accounting Training in Mohali training institute , then 4Achievers is the perfect place for you. 4Achievers institute offers best-in-class Corporate Training in UK Accounting Training in Mohali training courses that will equip you with the skills and knowledge you need to succeed in the Corporate Training in UK Accounting Training in Mohali industry.Corporate Training in UK Accounting Training in Mohali course Test Series Classed provides students with the necessary resources to pass their Corporate Training in UK Accounting Training in Mohali research tests.

Are you looking for a top-notch Corporate Training in UK Accounting Training in Mohali training institute ? Look no further, 4Achievers Corporate Training in UK Accounting Training in Mohali is the right choice for you! Our institute offers state-of-the-art Corporate Training in UK Accounting Training in Mohali courses that will help you gain the skills and knowledge you need to stand out in the job market.If you are looking to improve your Corporate Training in UK Accounting Training in Mohali skills, I would recommend enrolling in a live project working, test series classed class.

Want to make a career change? Do you want to learn new technologies in a hands-on environment? Then check out our Corporate Training in UK Accounting Training in Mohali Training Institute ! We offer various Corporate Training in UK Accounting Training in Mohali courses that will help you get ahead in your Career.Corporate Training in UK Accounting Training in Mohali Corporate Training in UK Accounting Training in Mohali Course MOC Interview Preparation Classed can help you get a job.If you're looking to improve your Corporate Training in UK Accounting Training in Mohali skills, this is the course for you!

4Achievers offers Corporate Training in UK Accounting Training in Mohali training courses that are job assistance, then 4Achievers Corporate Training in UK Accounting Training in Mohali Institute is the right place for you. 4Achievers courses are designed to help you get a foothold in the tech industry and get started on your career ladder. 4Achievers cover different technologies, and 4Achievers institutes offer hands-on training so that you can learn how to use these technologies in the real world.

Are you looking for a Corporate Training in UK Accounting course in Mohali? 4achievers is the perfect provider for you! 4Achievers Corporate Training in UK Accounting course is designed to provide you with the skills and knowledge you need to become a successful accountant in the UK.

4Achievers Corporate Training in UK Accounting course in Mohali is designed to provide you with the skills and knowledge you need to become a successful accountant in the UK. You will learn the fundamentals of accounting, including the principles of double-entry bookkeeping, financial statement preparation, and taxation. You will also gain an understanding of the UK accounting environment, including the legal and regulatory framework.

In the United Kingdom, companies must adhere to the Financial Reporting Council’s Financial Reporting Standard (FRS) 101 regarding the recognition of provisions for impairment of assets. This standard requires companies to assess the carrying amount of its non-financial assets, such as property, plant, and equipment, as well as intangible assets, against their recoverable amounts. If the carrying amount of an asset exceeds its recoverable amount, a provision must be recognised for the impairment.

4Achievers recoverable amount of an asset is the higher of its fair value less costs to sell and its value in use. Fair value less costs to sell is the amount obtainable from the disposal of the asset in an arm’s length transaction between knowledgeable, willing parties, less the costs of disposal. Value in use is the present value of the future cash flows expected to be derived from the asset.

4Achievers impairment loss, or the amount of the provision, is the difference between the carrying amount and the recoverable amount. This impairment loss must be recognised in the income statement as an expense. Additionally, the carrying amount of the asset must be reduced to its recoverable amount and, if the recoverable amount is less than the carrying amount, a corresponding impairment loss must be recognised.

4Achievers FRS 101 also requires companies to make an annual impairment review of non-financial assets, and to disclose the amount of any impairment losses recognised in its financial statements. Furthermore, companies must disclose the carrying amount and recoverable amount of its non-financial assets, as well as any impairment losses that have been reversed during the reporting period.

4Achievers UK requires corporate entities to recognise provisions for employee benefits in accordance with IFRS 2, Share-based Payment. This requires entities to recognise a liability for employee benefits when services are rendered and an expense when the liability is settled. 4Achievers amount of the liability should be determined using a fair value basis, taking into account the terms and conditions of the share-based payment plan. Entities should also recognise the associated costs of employee benefits, such as the cost of issuing shares, legal costs and other transaction costs.

4Achievers UK also requires corporate entities to recognise the actuarial gains and losses arising from employee benefit plans. These should be recognised in the statement of comprehensive income when they occur and are considered to be material. Entities should also recognise the associated costs of employee benefits, such as the cost of actuarial services and any other costs related to the operation of the plan.

4Achievers UK also requires corporate entities to recognise the assets associated with employee benefit plans. These assets should be recognised at their fair value and any changes in fair value should be recognised in the statement of comprehensive income. Furthermore, entities should recognise any gains or losses arising from changes in the assumptions used in the measurement of the asset.

In addition, the UK requires corporate entities to recognise the present value of any future employee benefit obligations. This should be done using a discount rate that reflects the current market rate of return on high-quality corporate bonds. 4Achievers amount of the obligation should be recognised in the statement of financial position and the associated costs should be recognised in the statement of comprehensive income.

Finally, the UK requires corporate entities to recognise the effect of any changes in employee benefit policies on the financial statements. Any changes in benefit policies should be recognised as a change in accounting estimates and be reflected in the statement of comprehensive income.

Overall, the UK requires corporate entities to recognise provisions for employee benefits in accordance with IFRS 2 and recognise the associated assets, liabilities and costs in their financial statements. Entities should also recognise the present value of any future employee benefit obligations and the effect of any changes in employee benefit policies on the financial statements.

Corporate entities in the UK are subject to taxation, and must recognise the relevant provisions in their financial statements. Generally Accepted Accounting Principles (GAAP) require companies to make appropriations for taxes payable in the current and future financial periods. This is known as a provision for taxation.

In order to make a provision for taxation, a company must first determine the total amount of tax due. This is done by calculating the taxable income for the period and applying the relevant tax rates. 4Achievers amount of tax payable is then compared to the amount of tax already paid, and any difference is the amount that must be recognised as a provision for taxation.

4Achievers company must also ensure that the provision for taxation is recognised in the correct accounting period. This requires an assessment of the expected timing of the payment of the tax liability, taking into account both statutory due dates and any special arrangements that may be in place. 4Achievers is also important to ensure that provisions for taxation are not overstated, as this can lead to serious financial consequences.

Finally, companies must also ensure that they accurately record any deferred tax liabilities or assets. Deferred tax liabilities are recognised when the company is expecting to pay more tax in the future, while deferred tax assets are recognised when the company is expecting to pay less tax in the future.

Overall, making a provision for taxation is a complex process, and companies should seek professional advice if they are unsure of the requirements. 4Achievers is also important to ensure that any provision for taxation is regularly monitored and updated to reflect changing circumstances.

In the UK, corporate entities are required to recognize provisions for future losses on investments in accordance with the Financial Reporting Council's (FRC) Financial Reporting Standard (FRS) 102. This standard outlines the principles for recognizing and measuring provisions for future losses on investments in the financial statements of corporate entities.

Under FRS 102, a provision for future losses on investments is recognized when a corporate entity has a present obligation, either legal or constructive, as a result of a past event, and it is probable that an outflow of economic benefits will be required to settle the obligation. 4Achievers amount recognized should be the best estimate of the expenditure required to settle the present obligation at the reporting date.

In order to recognize a provision for future losses on investments, a corporate entity must have evidence of an existing legal or constructive obligation, and must be able to estimate the amount of economic benefit required to settle the obligation. 4Achievers evidence must be sufficient to enable the corporate entity to make a reliable estimate of the amount of the provision.

When assessing the reliability of the estimate of the provision, the corporate entity must consider all available information, including the nature of the obligation, its terms and conditions, the entity's experience and any external sources of information. In addition, the corporate entity must consider any uncertainties that may affect the estimate of the provision.

Finally, in order to recognize a provision for future losses on investments, the corporate entity must consider whether there is any other information that would affect its estimate of the provision. This could include any changes in the laws or regulations, or any other significant events or changes in circumstances that may have occurred since the reporting date.

In the UK, provisions for contingent liabilities must meet certain requirements in order to be recognised. Firstly, a company must have a present obligation that is present as a result of a past event. This obligation must be probable, meaning it is more likely than not that the company will be required to settle the liability. 4Achievers amount must also be reliably estimable, meaning that the company can accurately measure the amount of the liability. Furthermore, the amount must be material to the company’s financial position. Finally, the provision must have an economic purpose, which means that the company recognises that the cost of settling the liability is lower than not taking any action.

In addition, a company must disclose any provisions for contingent liabilities in the financial statements. This means that the company must provide information about the nature of any contingent liabilities, the amount of any liabilities that have been recognised, and an estimate of any additional liabilities that may arise. This disclosure helps investors to gain a better understanding of the company’s financial position.

4Achievers UK's Companies Act 2006 outlines the requirements for recognising provisions for warranties. In order to recognise a provision for warranties, the company must have a validly executed contract in place that contains an enforceable and specific warranty. 4Achievers warranty must be measurable and the cost of providing the warranty must be estimable. Additionally, the warranty must be for a period of time that is not longer than 12 months from the date of the contract.

4Achievers company must also be able to demonstrate that the warranty is legally enforceable and that the company is able to meet any associated liabilities. 4Achievers must also be able to demonstrate that any material costs associated with the warranty are reasonable in relation to the benefits provided.

4Achievers company must also consider the potential future costs associated with the warranty and make appropriate provisions for them. This includes potential costs for the repair or replacement of defective products or services. 4Achievers company must also ensure that the warranty is properly documented and that all related costs are included in the financial statements.

Finally, the company must ensure that the warranty is properly monitored and audited on an ongoing basis. This includes ensuring that any defects or complaints are addressed in a timely manner and that any relevant changes in the warranty are properly documented. In addition, the company must ensure that its warranties are properly communicated to customers and that customer satisfaction is properly monitored.

In the UK, companies must meet certain requirements in order to recognise provisions for dividends. First and foremost, the company must have sufficient distributable profits to cover the dividend payment. This is established by preparing a statutory profit and loss account and balance sheet, in accordance with the Companies Act 2006. If a company has insufficient profits, it cannot recognise a provision for a dividend.

4Achievers company must also have an adequate level of liquid assets to cover the dividend payment. Liquid assets are defined as cash or assets that can be easily converted into cash, such as shares and bonds. A company must demonstrate that it has sufficient liquid assets to cover the proposed dividend payment, in order to recognise a provision for dividends.

4Achievers company must also have a current dividend policy in place. This should be made clear to shareholders in the company's annual report and accounts. 4Achievers dividend policy should set out the company's intentions regarding the payment of dividends, and the timing of such payments.

Finally, the company must ensure that it complies with the Companies Act 2006. This Act specifies the requirements for the payment of dividends, such as the requirement to pay dividends within 10 months of the end of the financial year.

In summary, in order for a company to recognise a provision for dividends, it must have sufficient distributable profits, adequate liquid assets and a current dividend policy, as well as comply with the Companies Act 2006.

In the UK, provisions for debt refinancing costs are treated as expenses and must be recognised under Generally Accepted Accounting Principles (GAAP). For a corporate entity to recognise such a provision, the following requirements must be met:

1. 4Achievers debt refinancing costs must have been incurred by the entity. This means that the entity must have made payments towards the refinancing of its debt.

2. 4Achievers debt refinancing costs must be measurable. This means that the costs must be quantifiable, so that the exact amount of the provision can be calculated.

3. 4Achievers debt refinancing costs must be probable. This means that it is likely that the entity will incur these costs, based on the evidence available.

4. 4Achievers debt refinancing costs must be related to the original debt or to the refinancing of the debt. This means that the costs must have been incurred as a direct result of the refinancing of the debt.

5. 4Achievers debt refinancing costs must be related to the current period. This means that the costs must be incurred and recognised within the same accounting period in which the refinancing takes place.

6. 4Achievers debt refinancing costs must be separately identifiable. This means that the costs must be clearly and distinctly identifiable as costs related to the refinancing of the debt, and not to any other activity.

7. 4Achievers debt refinancing costs must be disclosed in the financial statements. This means that the costs must be disclosed separately in the financial statements, so that the financial position of the entity is accurately represented.

By meeting these requirements, a corporate entity in the UK can recognise a provision for debt refinancing costs. This allows the entity to accurately and fairly reflect the costs associated with refinancing its debt in its financial statements.

In the UK, companies are required to recognize provisions for capital expenditure in their financial statements according to International Financial Reporting Standards (IFRS).

4Achievers first requirement is that the expenditure must meet the definition of a capital expenditure. This means that the expenditure must be for the acquisition of an asset that will provide future economic benefits, or for the improvement of an existing asset. 4Achievers expenditure must also be expected to last for more than one accounting period, and the cost of the asset must be greater than the amount of expenditure that is usually associated with the purchase of consumable items.

4Achievers second requirement is that the expenditure must be properly authorized. This means that the expenditure must be approved by the board of directors and that the board must also approve the capital expenditure budget.

4Achievers third requirement is that the expenditure must be adequately documented. This means that the company must keep records of the expenditure, including invoices, contracts, and other relevant documents. This documentation should be kept for a minimum of seven years.

4Achievers fourth requirement is that the expenditure must be adequately monitored and reported. This means that the company must track the expenditure and report it in their financial statements. 4Achievers company should also be able to explain the reasons for the expenditure and the expected benefits.

Finally, the fifth requirement is that the expenditure must be recorded in the company’s books of accounts. This means that the expenditure must be recorded in the company’s financial statements in accordance with IFRS. 4Achievers company must also ensure that the accounting for the expenditure is accurate and up to date.

In the UK, companies must meet certain requirements for the recognition of provisions for long-term debt. Firstly, the debtor must be legally obligated to pay a certain sum of money at a specified future date. 4Achievers debt must also be due to the creditor, typically a financial institution, after the balance sheet date. In addition, the amount must be reliably estimable and the company must have sufficient available funds to settle the debt.

4Achievers provisions must also be related to a specific debt, rather than a general obligation. 4Achievers company must have a contractual agreement in place with the creditor, which outlines the repayment terms and conditions. 4Achievers company must also have a valid reason to make the provision, such as an anticipated increase in interest rates or a change in the borrower’s financial situation.

4Achievers amount of the provision must be supported by sufficient evidence and must be reasonable in relation to the amount of the debt. Companies are also required to make a provision for the expected costs of any legal or other expenses associated with the debt. 4Achievers company must also keep accurate records of the debt, including the amount and terms of repayment.

Finally, the company must disclose the amount of the provision and its terms in the financial statements. This information should be disclosed in a note to the financial statements, and should include an explanation of the reasons for the provision. In addition, the company must provide a description of the debt, its terms and conditions, and any other relevant information.

at 4Achievers

Very Satisfied

at

4Achievers Corporate Training in Machine Learning Training in Mohali Course Covers: Introduction | Basic | Project Implementation | Testing | Architecture | Advance Learning | Interview Preparation | JOB Assistance

4Achievers Corporate Training in Advance Excel with VBA Training in Mohali Course Covers: Introduction | Basic | Project Implementation | Testing | Architecture | Advance Learning | Interview Preparation | JOB Assistance

4Achievers Corporate Training in Business Analytics Training in Mohali Course Covers: Introduction | Basic | Project Implementation | Testing | Architecture | Advance Learning | Interview Preparation | JOB Assistance

4Achievers Corporate Training in Net Suites Training in Mohali Course Covers: Introduction | Basic | Project Implementation | Testing | Architecture | Advance Learning | Interview Preparation | JOB Assistance

4Achievers Corporate Training in Oracle Fusion Training in Mohali Course Covers: Introduction | Basic | Project Implementation | Testing | Architecture | Advance Learning | Interview Preparation | JOB Assistance

4Achievers Corporate Training in Java Programming Training in Mohali Course Covers: Introduction | Basic | Project Implementation | Testing | Architecture | Advance Learning | Interview Preparation | JOB Assistance

4Achievers Corporate Training in US IT Staffing Training in Mohali Course Covers: Introduction | Basic | Project Implementation | Testing | Architecture | Advance Learning | Interview Preparation | JOB Assistance

4Achievers Corporate Training in Tableau Training in Mohali Course Covers: Introduction | Basic | Project Implementation | Testing | Architecture | Advance Learning | Interview Preparation | JOB Assistance

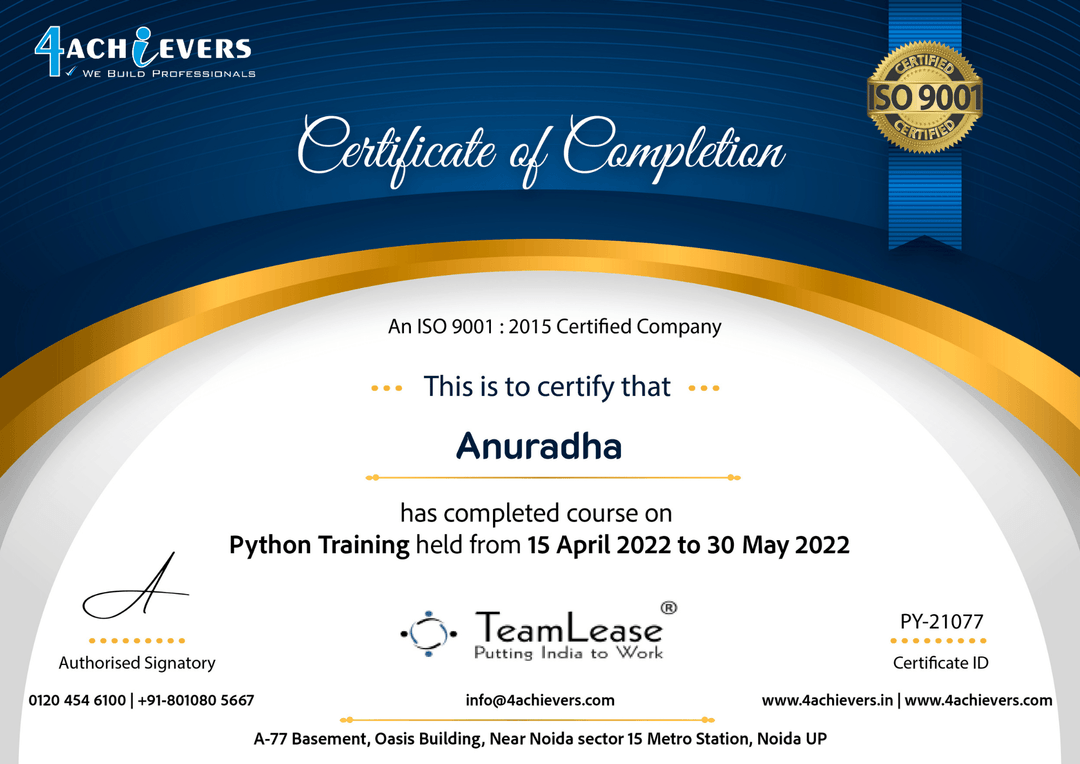

Are you looking to find your next job in trending technology? 4Achievers has the perfect solution for you. 4Achievers software testing course will teach you everything you need to become a successful Expert. Not only that, but 4Achievers program is available online and offline class and can be completed in just a few weeks. so don't wait any longer and sign up today!

First touchpoint for customer Initial handling of all customer tickets Track to closure of customer tickets by assisting the responsible teams System software and AWS/Azure infrastructure L1/L2 support Newgen solution / application L1/L2 support Responsib

Experience: 0 to 4 years Qualification:B.SC, B.Tech/BE/MCA Skills in one or more of JavaScript,CSS, Web application framework viz. Sencha EXT JS, JQuery etc., Delphi,C,C++,or Java..net,testing Cloud Administrator-managing Windows based Servers

Developing and deploying new applications on the windows azure PAAS platform using C#, .net core . Participation in the creation and management of databases like SQL server and MySQL Understanding of data storage technology (RDBMS, NO SQL). Manage applica

Experience of Dev Ops technologies, architectures and processes for 3 yrs Cloud Infrastructures Solutions: AWS EC2 ECS, S3 Cloudfront, RDS, Spot Instances, VPC, IAM, Security Groups, ELB etc), GCP, CI/CD Jenkins Containerization: Docker, Kubernetes System

Must have good knowledge of Google Cloud (GCP), Good To Have- AWS and. Azure Cloud automation, with overall cloud computing experience. Good knowledge of Windows Server and IIS (Internet Information Services). Good knowledge of .NET applications (ASP.Net,

Good Knowledge in both Manual Testing and Automation Testing,Strong experience in writing test scenarios and test cases Strong knowledge on Selenium, Appium, Microsoft SQL and Jmeter Adept in functional testing and reporting defects

Design, execute and report software tests, Review business / software requirements and provide inputs. Prepare test cases, test scripts and test data., Execute tests (manual / automated). Report defects and assist in their understanding., Analyse test re

Good Knowledge in both Manual Testing and Automation Testing,Strong experience in writing test scenarios and test cases Strong knowledge on Selenium, Appium, Microsoft SQL and Jmeter Adept in functional testing and reporting defects

4Achievers offers the step-by-step guide to get your dream job after completing Course.